What is an Order in Trading?

In the trading context, an order represents a trader’s intent to buy or sell a particular asset at the current price or a specified price. It is an instruction given to a third party (broker, bank, exchange) to execute a trade on behalf of the trader.

Orders can range from basic to complex, created to fulfill varying trading intents. Without orders there are no markets as they are the primary means of communication between a buyer and seller, ensuring that financial exchanges run smoothly. In today’s markets, orders are processed mainly by automated systems, which enables rapid execution and minimization of human errors.

The financial markets process millions of orders per time and one execution can trigger a series of others which creates a chain reaction of price fluctuations. This interconnected nature of the markets is due to orders.

That said, due to the number of orders and their complexity, brokers, and exchanges are mandated to ensure the reliability of their order-clearing systems to prevent price disruptions.

Understanding the different order types and how they affect the market is vital to effectively navigating the markets.

Top 6 Order Types

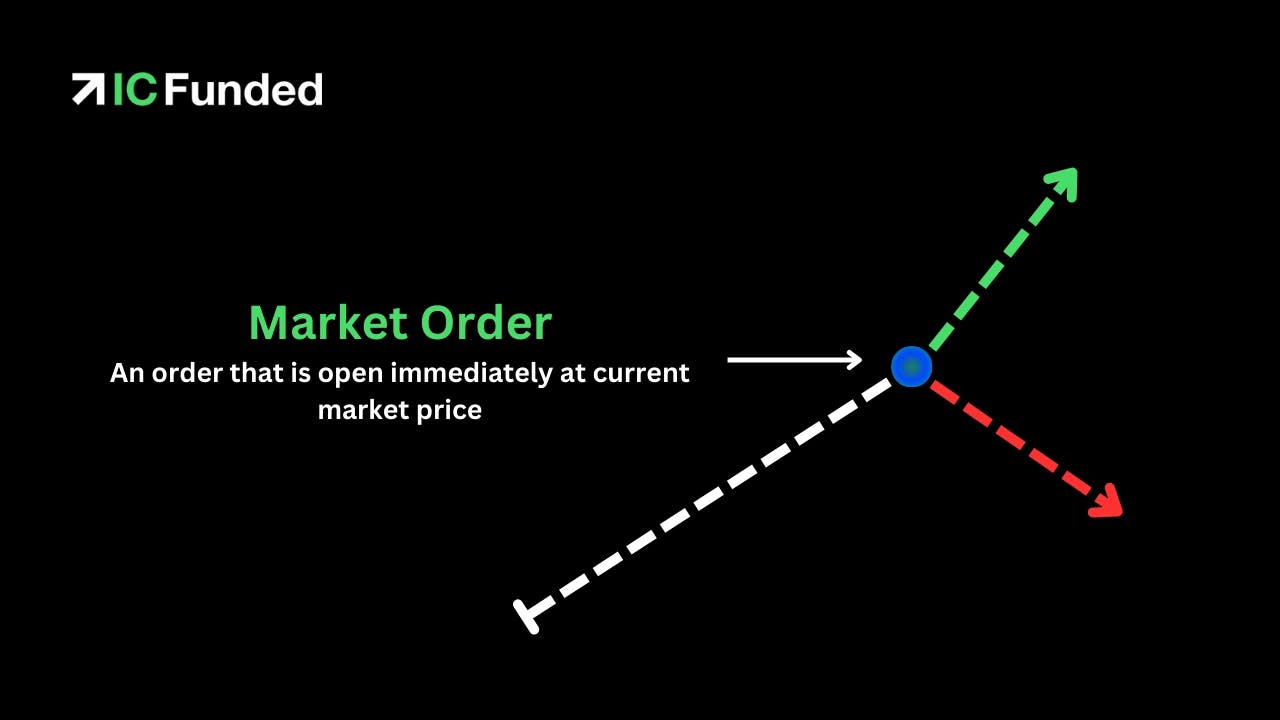

Market Order

A market order isa request from a trader to a broker to buy or sell an asset immediately at the best available price. A market order is used when the goal is to execute a trade immediately.

While it ensures the execution of the trade, it doesn't guarantee a specific price. A market order is executed immediately at the current market price, regardless of whether the price is favorable or unfavorable for the trader.

A market order is suitable for traders who are not concerned about the exact price they execute their trades. It is also useful if you need to execute a trade quickly to avoid a significant price movement. This order type is suitable for day traders who want to take advantage of short-term price movements.

Also, when placing market orders the market needs to have a certain level of liquidity. If there is not enough liquidity, the request may not be executed or may be filled at a price far from the current price.

Market orders are best for assets with high liquidity and trading volume. Assets with high volume and liquidity often have narrow bid-ask spreads, this reduces the price slippage for market orders. This order type is not suitable for assets with low liquidity or trading volume because they are susceptible to significant price slippage, which can result in the trader paying more than the market cost to execute the trade.

Aside from the fast execution of trades, another benefit of market orders is the absence of price restrictions. This means that there are no price limits on trades. Trades can be executed at the best available price. This is often useful in volatile market conditions.

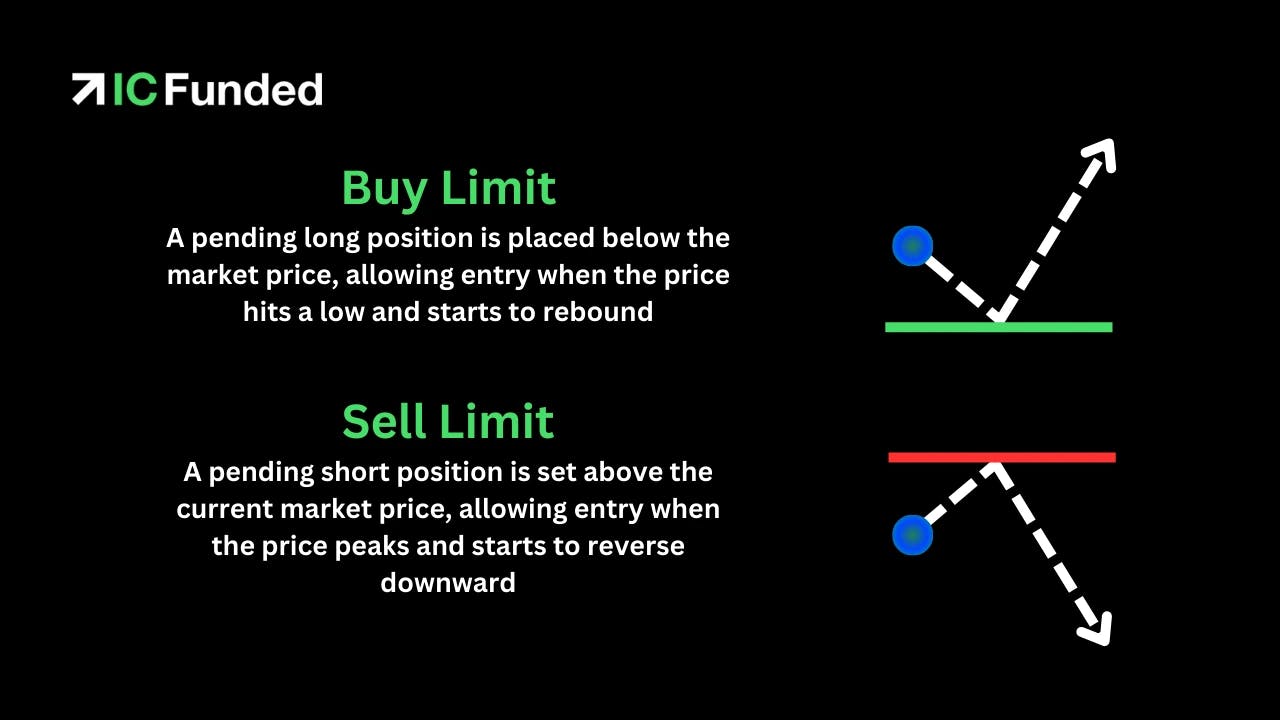

Limit Order

This trading order instructs a broker to buy or sell an asset at a specific price. The limit order restricts the maximum price to buy (buy limit order) or the minimum price to be received (sell limit order).

With a limit order, the trade only becomes active when the price reaches the specified limit price. If the market price does not reach the set price, the trade will not be executed until it expires.

Aside from being a trading order type, limit order is also a risk management strategy.

Limit Orders are also suitable for traders who are price-sensitive and want to have more control over their transactions. The ability to specify the exact price to execute a trade provides some degree of control in volatile financial markets.

Day traders who wish to take advantage of small price movements may not find this order type appealing as it can result in delayed execution or unfulfilled orders.

Limit orders help traders to avoid overpaying or underselling. With this order type, traders can set a price floor or ceiling if they are bothered about paying too much or selling for too little.

That said, limit orders are not suitable for highly volatile markets. In highly volatile markets, the prices of assets fluctuate so fast that it becomes difficult to predict whether a limit order will be executed. It is also not suitable for time-sensitive trades as limit orders are not executed immediately and it may be hard to tell if the market price will get to the set price.

Stop Order

A stop order is a trading order to buy or sell an asset at the market price when the asset has traded at or hit a specific price.

In most cases, selecting a price worse than the current price is known as a stop order. With stop orders traders often buy worse (at a higher price) or sell at a lower price.

- Buy Stop Order: A buy stop order is used when you want to buy an asset at a price above the current market price. It’s often used by traders expecting a breakout. Once the asset hits the stop price, the order converts to a market order and gets executed at the next available price.

- Sell Stop Order: A sell stop order is the opposite of a buy stop. It’s used to sell an asset if its price drops to or below a certain level.

- Stop Loss Order: A stop loss order is designed to limit the potential loss on a trade. Traders use it to exit a position automatically if the market moves unfavorably. For instance, if you buy a stock at $100 and don’t want to risk losing more than $10 per share, you can set a stop loss order at $90. If the stock price drops to $90, the stop loss order will sell your shares, helping to cap your losses. It’s a key risk management tool that helps protect your capital.

Since this order type is automated, such traders can easily protect their position against market volatility without actively monitoring the market. Stop orders are not suitable for traders who want to time the market. It is also not recommended for traders concerned about the risk of slippage, which can occur when a stop order is executed.

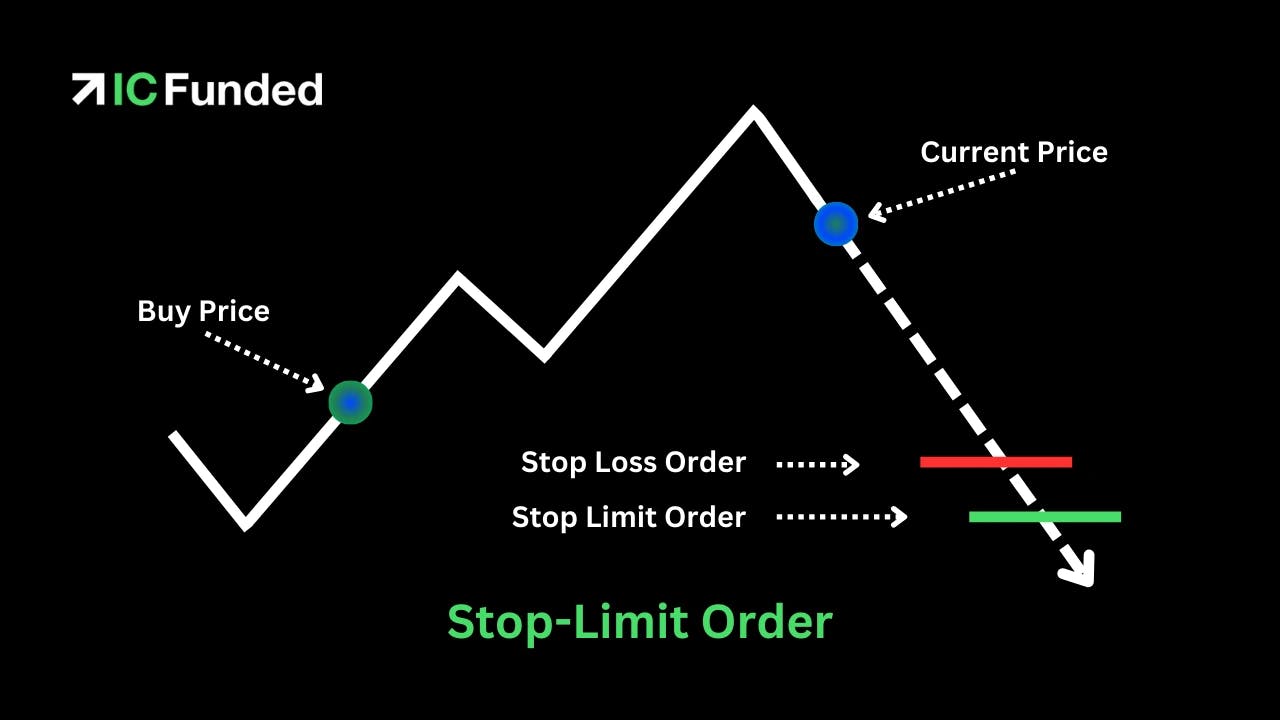

Stop-Limit Order

A stop limit order is a conditional trade order that combines the functions of a stop and limit order. With a stop-limit order, you need to place 2 prices - the stop price and the limit price. If the asset hits the preset stop price then your order becomes a limit order.

Stop-limit orders unlike stop orders ensure a price boundary based on your preset limit price. Stop orders, on the other hand, guarantee order execution but not necessarily at the exact specified price.

For instance, if Microsoft is trading at $155 and you want to buy the share once it begins to have upward movements then you’ll place a stop-limit order to buy at a stop price of $160, and a limit price of $165.

So if the price of Microsoft shares moves above your $160 stop price, the order will be activated and turn into a limit order. This is as long as the order can be executed below $165, which is your preset limit order price. However, if Microsoft shares gaps above $165, then your order will not be executed.

You can buy or sell with a stop-limit order. Buy stop-limit orders are set above the market price at the time you’re placing the order but sell stop-limit orders are placed under the current market price.

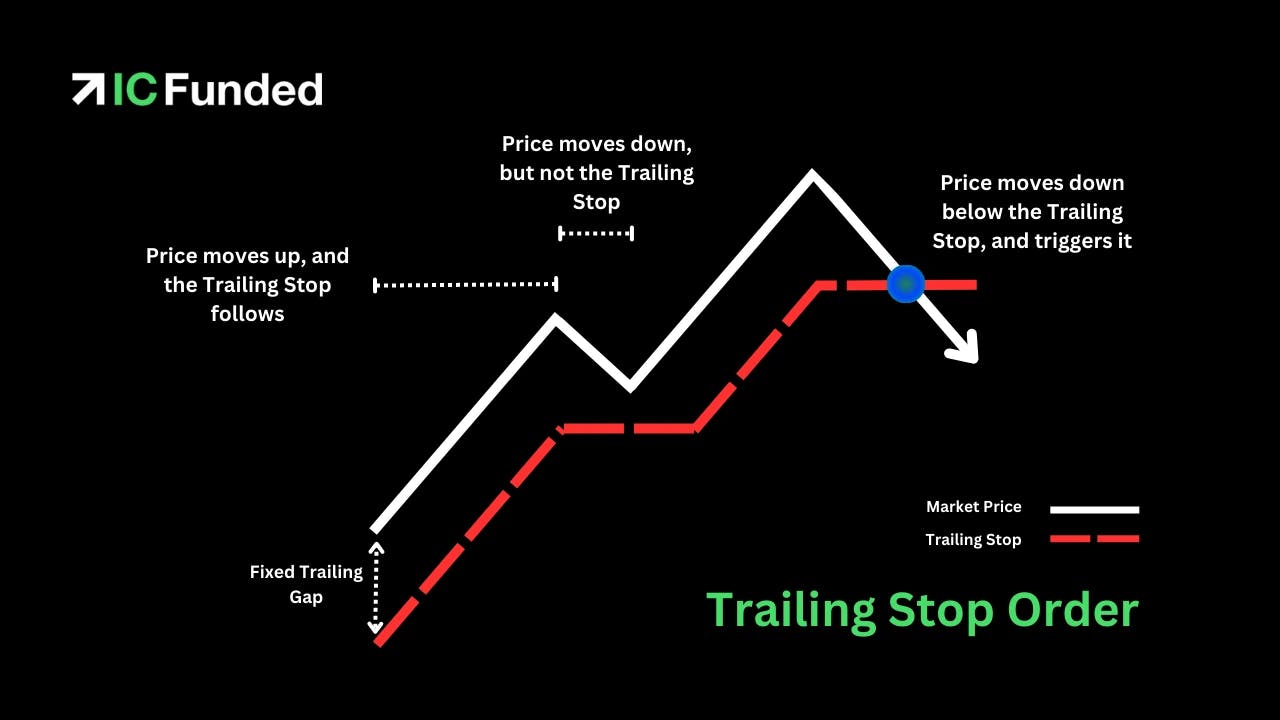

Trailing Stop Order

A trailing stop order is a type of stop-loss that follows your position. If the price of the asset or underlying asset rises, it secures your position. However, if the asset or stock price falls, it remains in place and closes your position.

Unlike a regular stop loss, a trailing stop order does not place the stop level at a specified price, but rather at a preset distance from the current price. If you’re opening a buy position, you’d place your trailing stop order below the current price but if you’re opening a sell position, you’ll place it above the current price.

Basically, the trailing stop is set at a certain number of points away or at a percentage level from the current market price. The order will move according to the percentage set if the price moves in your speculated direction.

Good ‘Til Canceled (GTC) Orders

A Good ‘til canceled (GTC) order is a type of order that you can place to buy or sell an asset or underlying asset that remains active till the order is executed (filled) or you cancel it. Brokerages typically limit the maximum time that a GTC order can be open to approximately 90 days. This can vary depending on the broker.

GTC orders are alternatives to day orders which expire if unexecuted at the end of a trading day. However, they are not open indefinitely but have an expiration timeframe set by the broker to prevent long-forgotten orders from suddenly executing. They are used primarily by traders who do not want to constantly watch market prices allowing them to place a buy or sell order at specified price points.

What Is an Order Execution?

An order execution is the process of completing a buy or sell order. Order execution happens when the order is filled, not when it is placed or requested. When a trader submits a trade, it is forwarded to the broker, who determines the best way to execute it. The process is usually automated.

Conclusion

Orders are the backbone of trading as they facilitate the buying or selling of assets in the financial markets. From the basic market order executed at the current price to complex stop/limit orders, trailing stop orders, etc. that manage risk and secure positions, these tools are essential for traders.

These are done by automated systems to ensure the quick execution of orders and to help minimize errors. Understanding these order types is crucial if you want to become a professional trader.

FAQ

What is the Most Common Type of Order?

The most common order type is the market order.

What is Slippage?

Slippage is a discrepancy that occurs when the expected price of a position and its actual value differ at the time of order execution.

Why Do Traders Use Orders?

Traders use orders to manage risks, secure positive positions, and execute trades based on their trading strategies.